[Income Tax in Korea] Housing rental income

we will discuss the key aspects of reporting housing rental income and the associated income tax regulations in Korea.

Persons Subject to Reporting Housing Rental Income

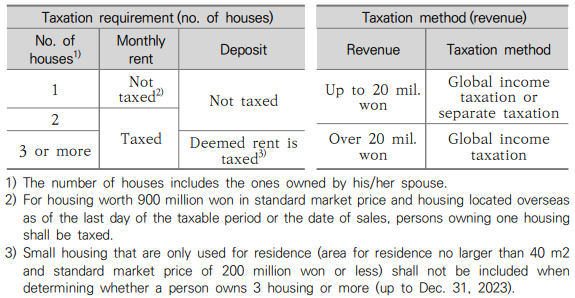

Individuals who own residential properties meeting any of the following criteria are required to report their housing rental income:

- Persons owning housing over 900 million won in standard market price with monthly rental income, housing located overseas, two or more housing, and persons owning three or more housing who received total rental deposits over 300 million won should file a report on present state of business place including the amount of income by Feb. 10 and file and pay income tax in May.

Definition of Housing and Calculation of the Number of Housing

For tax purposes, "housing" refers to a building intended for full-time residential use, excluding residential housing for business purposes. It also includes the attached land. The criteria for determining the number of housing units owned are as follows:

- 1. The total floor area of the building (excluding underground floors, parking areas aboveground, shelter safety zones under Article 34 (3) of the Enforcement Decree of the Building Act, and common facilities under subparagraph 3 of Article 2 of the Regulations on Housing Construction Standards, etc.).

- 2. The area calculated by multiplying the area the building is established by five (10 in the case of land outside urban areas under subparagraph 1 of Article 6 of the National Land Planning and Utilization Act).

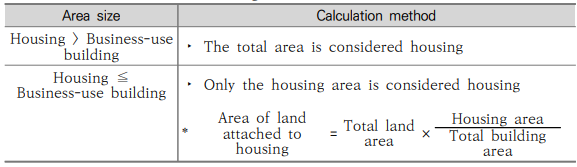

Where a business-use building for which VAT is taxed is also installed

In cases where a business-use building subject to VAT is also installed on the property, additional considerations apply.

How to Calculate the Number of Housing

Calculation of the Amount of Gross Revenue

The sum of the amount of revenue that incurred or will incur during the relevant taxable period

Gross housing rental revenue = Monthly rent + Deemed rent for deposit, etc.

Calculation of gross revenue of advance rents ( Article 51, Enforcement Decree of the Income Tax Act)

- Gross revenue amount = Advance rents x (no. of months during the rental period / no. of months during the contract period)

- No. of months :

- ① One month if the month to which the commencement date of the relevant contract period belongs is less than one month

- ② Zero months if the month to which the last day of the relevant contract period belongs is less than one month

- No. of months :

Deemed Rent on Deposit, etc.

Where a resident owns three or more housing and the sum of their deposits, etc. exceeds 300 million won, deemed rent shall be included in the total amount of income.

- Housing whose area for residential use is not more than 40 m2 per family or household and the standard market price of which is not more than 200 million won during the relevant taxable period shall not be included when determining whether a person owns 3 or more housing (up to Dec. 31, 2023).

Attributable Year of Total Revenue

The attributable year of total revenue for each taxable period is determined based on the date on which the total revenue was finalized.

- Where the date of payment is decided based on a contract or custom

- The day the determination is made

- Where the date of payment is not decided based on a contract or custom

- The day payment is made

Separate Taxation of Housing Rental Income (Article 64-2 of the Income Tax Act, Article 122-2 of its Enforcement Decree)

Starting from income attributable to 2019, if the sum of gross revenue from housing rental is at or below 20 million won, either global taxation or separate taxation can be chosen ( Article 64-2 of the Income Tax Act, Article 112-2 of its Enforcement Decree).

Options:

① (Housing rental income + Other income subject to global taxation) × Progressive tax rate (6-45%)

② Housing rental income × 14% + Other income subject to global taxation × Progressive tax rate (6-45%)

Penalty Tax for Non-Registration as Housing Rental Business (Article 81-12, Income Tax Act)

If a business with housing rental income fails to request business registration with the appropriate tax office within 20 days of commencing the housing rental business, a penalty tax will be imposed. The penalty tax amount is equivalent to 0.2% of the income from housing rental for the period from the business commencement date to the day before the date of applying for business registration. This penalty tax is added to the determined global income tax amount for the taxable period (Income from housing rental × 0.2%).

Penalty tax for non-registration as housing rental business = Income from housing rental × 0.2%

It's important to note that the penalty tax for non-registration as a housing rental business will be applied even if there is no calculated global income tax. This measure ensures compliance with registration requirements and encourages businesses to fulfill their tax obligations promptly.

* The penalty tax is applicable to businesses that started a housing rental business no later than Jan. 1, 2020. In such cases, if the housing rental business commenced before Dec. 31, 2019, Jan. 1, 2020, will be considered the official business commencement date.

Conclusion

In summary, individuals owning housing properties meeting specific criteria in Korea must report their housing rental income and pay income tax accordingly. Understanding the definitions and calculations related to housing units and gross revenue is essential for fulfilling tax obligations properly.

'세무정보 > Global Income Tax for foreign residents' 카테고리의 다른 글

| [Income Tax in Korea] Non-Taxable Income (0) | 2023.07.28 |

|---|---|

| [Income Tax in Korea] Non-global income (1) | 2023.07.28 |

| [Income Tax in Korea] Religious person’s income (0) | 2023.07.28 |

| [Income Tax in Korea] Double Entry Bookkeeping and Simplified Bookkeeping (0) | 2023.07.28 |

| [Income Tax in Korea] Understanding the Standard & Simplified Expense Rate System (1) | 2023.07.28 |